How to Slash Maintenance Costs While Boosting Bank Facility Efficiency

March 12, 2025

Bank facility executives face increasing pressure — shrinking margins, rising customer expectations, and strict regulatory mandates. Running a financial institution isn’t just about balancing the books — it’s about keeping multiple branches running smoothly, meeting strict security standards, and staying compliant with ever-evolving regulations, all while maintaining a seamless brand experience.

This guide delivers seven practical, data-backed strategies to help banks cut maintenance costs without cutting corners, ensuring every bank facility location operates efficiently and up to standard.

- Conduct a Comprehensive Audit: Identify inefficiencies and hidden cost drivers.

- Prioritize Preventive and Predictive Maintenance: Prevent costly emergency repairs.

- Centralize Maintenance Management: Streamline operations across multiple locations.

- Leverage Technology and IoT Solutions: Automate and monitor bank facility performance.

- Optimize Energy-Efficient Solutions: Lower bank facility utility expenses.

- Strengthen Vendor and Supplier Relationships: Improve service quality and pricing.

- Invest in Team Training and Continuous Improvement: Enhance skills, efficiency, and innovation.

By implementing these strategies, financial institutions can reduce costs, improve operations, and reinvest savings into customer-focused initiatives.

Tip 1 – Conduct a Comprehensive Facility Audit

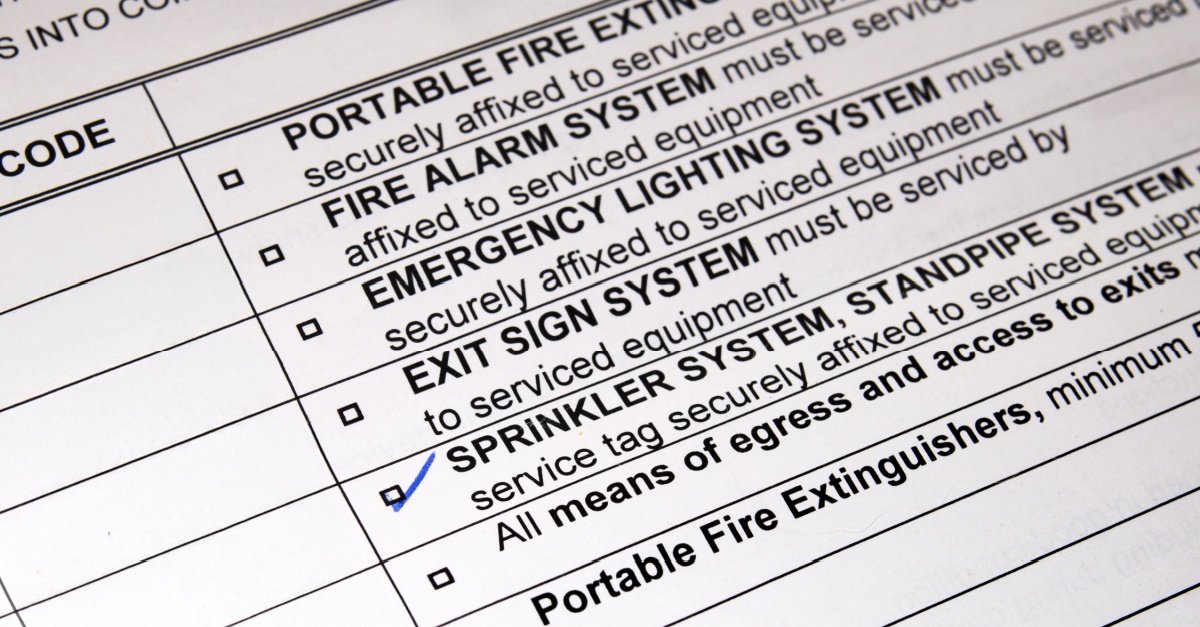

A comprehensive bank facility audit is a powerful strategy for reducing maintenance costs and improving operational efficiency. According to the International Facility Management Association (IFMA), organizations that proactively identify inefficiencies can lower maintenance expenses by up to 20%. A thorough audit begins with an inventory of all equipment and machinery, including HVAC systems, security cameras, alarms, ATMs, electrical systems, and plumbing. Next, assessing current energy usage helps pinpoint areas of waste, while reviewing routine and emergency repair logs highlights frequent failure points that may require preventive action.

To maximize results, businesses should schedule audits quarterly or semiannually using a standardized checklist and digital audit tool for accuracy and consistency. The benefits are twofold: gaining a clear understanding of equipment life cycles, real-time conditions, and associated costs, while also establishing a baseline for tracking future improvements. A proactive audit strategy not only slashes unnecessary expenses but also enhances facility performance for the long term.

Tip 2 – Prioritize Preventive and Predictive Maintenance

Reducing facility maintenance management costs while ensuring seamless bank facility operations requires a strategic approach. Prioritizing preventive and predictive maintenance is key to keeping critical infrastructure — such as ATMs, vaults, and HVAC systems — operational while avoiding costly emergency repairs. Preventive maintenance focuses on scheduled tasks like seasonal HVAC inspections, routine filter changes, and regular system checks to mitigate wear and tear. Predictive maintenance, on the other hand, leverages real-time sensor data and analytics to forecast when a component is likely to fail, allowing for proactive repairs before issues arise.

By adopting these strategies, bank branches can significantly reduce downtime, avoid unexpected repair expenses, and enhance the customer experience by ensuring a reliable, well-maintained environment.

To implement these approaches effectively, branches should integrate a computerized maintenance management system (CMMS) to track asset health, set up real-time alerts for early issue detection, and work with trained in-house technicians or specialized service providers. For example, predictive monitoring of an HVAC system could flag a failing compressor before peak summer temperatures hit, preventing a costly emergency repair and avoiding operational disruptions. Proactive maintenance isn’t just cost-effective — it’s essential for long-term efficiency.

Tip 3 – Centralize Maintenance Management

Facility maintenance management across multiple locations can be costly and inefficient when each branch follows different protocols. A decentralized approach often leads to missed opportunities for bulk purchasing, inconsistent vendor contracts, and a lack of standardization, all of which drive up costs. Scheduling inefficiencies can cause service gaps or redundant repairs, while tracking maintenance requests and expenditures across various systems becomes a logistical challenge. By centralizing facility maintenance management, businesses can streamline operations, reduce costs, and ensure a consistent brand experience at every location.

A single platform for submitting tickets and tracking work orders creates real-time visibility, allowing for better planning and quicker issue resolution. Consolidating maintenance budgets across all locations enables volume discounts, single invoicing, and better financial control. Additionally, assigning a dedicated facilities management team ensures compliance, efficiency, and consistency across all properties. The return on investment is clear — businesses that implement a centralized maintenance strategy typically reduce overhead costs by 10-15% due to improved efficiencies and economies of scale. By taking a strategic approach to maintenance, companies can cut costs while enhancing operational performance.

Tip 4 – Leverage Technology and IoT Solutions

The Internet of Things (IoT) is transforming facility maintenance management by enabling devices to communicate real-time data on usage, temperature, and performance, allowing banks to cut maintenance costs while enhancing operational efficiency. Smart technology is particularly beneficial for financial institutions where seamless operations and cost control are essential. For example, smart HVAC systems automatically adjust temperature settings during low-traffic hours, such as after the lobby closes, reducing unnecessary energy consumption. Similarly, predictive alerts for ATMs help prevent unexpected downtime by detecting usage patterns and triggering maintenance before failures occur.

Automated lighting controls optimize energy use by adjusting brightness based on occupancy, further lowering utility expenses. Beyond cost savings, IoT supports data-driven decision-making, providing real-time insights that eliminate unnecessary on-site inspections and help identify branches with aging infrastructure that may require faster upgrades. However, banks must also prioritize compliance and security, ensuring IoT systems utilize encryption and secure network protocols to meet strict banking regulations.

By leveraging IoT, banks can streamline operations, reduce maintenance expenses, and improve the overall customer experience — all while staying compliant and secure.

Tip 5 – Optimize Energy Efficiency Initiatives

Optimizing energy efficiency is a powerful yet often overlooked strategy for cutting costs and improving operations. Energy expenses can account for up to 30% of a facility’s total operating budget, particularly in energy-intensive climates. Without proactive management, inefficient lighting, outdated HVAC systems, and unnecessary energy use drain resources and erode profitability. However, simple upgrades can drive immediate savings. Retrofitting branches with LED lighting reduces electricity costs while improving brightness and longevity. Installing smart thermostats and zoning controls ensures HVAC systems run efficiently, preventing energy waste. Additionally, implementing scheduled lighting and equipment shutdowns during nonoperating hours eliminates unnecessary power consumption.

Beyond direct savings, businesses can leverage state and federal incentives for green retrofits, improving ROI on energy-saving investments and reducing upfront costs. These initiatives not only lower operational expenses but also strengthen long-term sustainability and brand image. Environmental responsibility resonates with customers and stakeholders, enhancing a company’s reputation and aligning with ESG (environmental, social, and governance) goals. By optimizing energy efficiency, businesses can cut costs while reinforcing their commitment to sustainability and operational excellence.

Tip 6 – Strengthen Vendor and Supplier Relationships

Strengthening vendor and supplier relationships is a powerful strategy to cut maintenance costs while improving operational efficiency. One key decision is vendor consolidation versus diversification. Consolidating with a few large vendors simplifies management, provides volume discounts, and ensures consistency, but it may limit flexibility. Diversifying with multiple specialized local partners enhances service quality and competition-driven pricing but increases administrative complexity. The best approach is a balanced mix — leveraging large vendors for standardization and local providers for niche expertise. Cost savings can also be achieved through better contract negotiations.

Businesses operating across multiple locations should explore volume-based discounts and service-level agreements (SLAs) to ensure accountability. Issuing requests for proposals (RFPs), defining clear performance metrics, and incorporating penalties for missed benchmarks drive vendor reliability. Ongoing vendor performance reviews, conducted quarterly or semiannually, help track response times, work quality, and cost competitiveness to prevent small inefficiencies from escalating. Beyond contracts, true partnerships matter. Maintaining open communication and sharing long-term plans, such as expansion or retrofitting, helps vendors align resources with business goals, ensuring sustainable cost savings and seamless operations.

Tip 7 – Invest in Team Training and a Continuous Improvement Culture

Even the best technology and strategies are ineffective without a knowledgeable team to implement them. Skilled employees act as the frontline defense against costly maintenance issues, detecting early warning signs before they escalate into expensive repairs. Investing in training and fostering a culture of continuous improvement drives long-term cost savings and operational efficiency.

Staff should receive essential training in basic troubleshooting for HVAC, electrical, and security systems, enabling them to resolve minor issues without costly service calls. Safety and compliance protocols tailored to banking environments help ensure regulatory adherence, while proficiency in CMMS and facility maintenance management tools streamlines maintenance workflows.

Encouraging staff to submit cost-saving ideas and recognizing high-performing individuals fosters engagement and accountability. Cross-training employees reduces reliance on external vendors, while introducing forward-looking skill sets — such as data analytics, IoT, and ESG — ensures teams remain adaptable to industry changes. Prioritizing training and continuous improvement not only enhances workforce capabilities but also strengthens the bottom line, creating a more resilient, cost-effective, and future-ready facility maintenance management strategy.

From Cost Center to Strategic Asset

Financial institutions that treat their bank facilities as strategic assets — not just cost centers — unlock greater uptime, superior customer experiences, and long-term savings. By conducting in-depth audits, adopting preventive and predictive maintenance, centralizing management, leveraging smart technology, optimizing energy use, strengthening vendor partnerships, and investing in team training, banks can transform their facilities into high-performing, brand-aligned spaces that drive growth and compliance.

At BrandPoint Services, we specialize in helping financial institutions streamline facilities management with tailored solutions designed for multilocation portfolios. From proactive maintenance and emergency repairs to energy-efficient upgrades and vendor coordination, our expert team ensures operational efficiency without compromising quality. Let us handle the complexities so you can focus on delivering exceptional customer experiences. Connect with BrandPoint Services today to optimize your facilities and reduce costs — without sacrificing performance.